Oligopoly is a market structure where a small number of large firms dominate the industry. There are high barriers to entry such as economies of scale, control of raw materials and large funds to pursue aggressive tactics such as advertising or threat of takeover. Thus making it very difficult for a new entrant to enter the market. The products produced by the firms are differentiated and mutual interdependence exists among the firms. Due to the small number of firms in the market, decisions made by one firm affect other firms in the industry. Therefore firms are keenly aware of the actions of rivals.

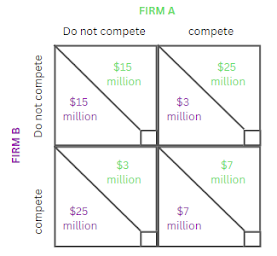

Mutual interdependence has an important implication for the behaviors' of oligopolistic firms. These firms have to behave in the most strategic way based on plans of action that take into account rival’s possible reactions to the firm's move. Hence firms in oligopoly has incentive to collude or to compete. Since they can’t collude and compete at the same time, firms have to choose either to collude or compete.

When firms collude, they can limit competition, increase monopoly power and increase joint profit. An example of collusion that is still in effect till today is OPEC (Organisation of Petroleum Exporting Countries). Diagram one below shows the effect of oligopoly firms collusion. As they limit production, the firms in the oligopolistic market act as a monopoly. The price will be higher and production lower than when they are not colluding. This enables them to maximize the amount of profit (shaded area) as shown in the diagram.

Higher prices means consumers have to pay more for the goods which reduces their purchasing power and potentially worsening their welfare if the said good is important for their livelihood (example internet services). Another implication of collusion is the inefficient allocation of resources. Since firms are not competing on price, there is no incentive to produce at the lowest costs possible resulting in productive inefficiency. Moreover resources are also not efficiently allocated as the price is not equal to MC, which means marginal benefit does not equal marginal costs.

Due to the rigidity in pricing in the oligopoly market, the market tends to prefer collusion even though it leads to higher prices and inefficient resource allocation. However, there are many obstacles in forming a collusion. The first is the cost difference between firms. Ideally, firms maximize profit when MR=MC, however since price agreed by all cartel members is common to all the firms, firms with higher average cost or lower average costs may have a different MC. They may not maximize profit individually. This could lead to some firms reaping higher profit while others may be left with lower profit. Thus agreeing to a common price might be challenging. Due to this, firms in the cartel have incentive to cheat by secretly offering lower prices to their buyers. If many firms engage in this practice the cartel may collapse. The success also depends on the number of firms in the industry. The larger the number of firms, the more difficult it would be to collude.

In conclusion, firms in the oligopoly market may have the incentive to collude as price competition is very unlikely. However there are many reasons collusion may not work as well. Conversely, it is illegal in many countries and it may not be successful if government policies are against collusion. Therefore firms in the oligopoly market would rather operate by other tactics such as aggressive marketing, better consumer services and differentiating their products from rivals as much as possible.